💰 Finance Management

Purpose

Manage financial transactions accurately and maintain comprehensive records for informed financial planning and analysis.

Scope

This SOP applies to financial analysts, accountants, and managers responsible for overseeing financial health and compliance.

Responsibilities

- Financial Analysts: Record and categorize financial transactions.

- Accountants: Maintain and update the ledger for reporting and compliance.

- Financial Managers: Review financial records and reports for strategic decision-making.

Metrics

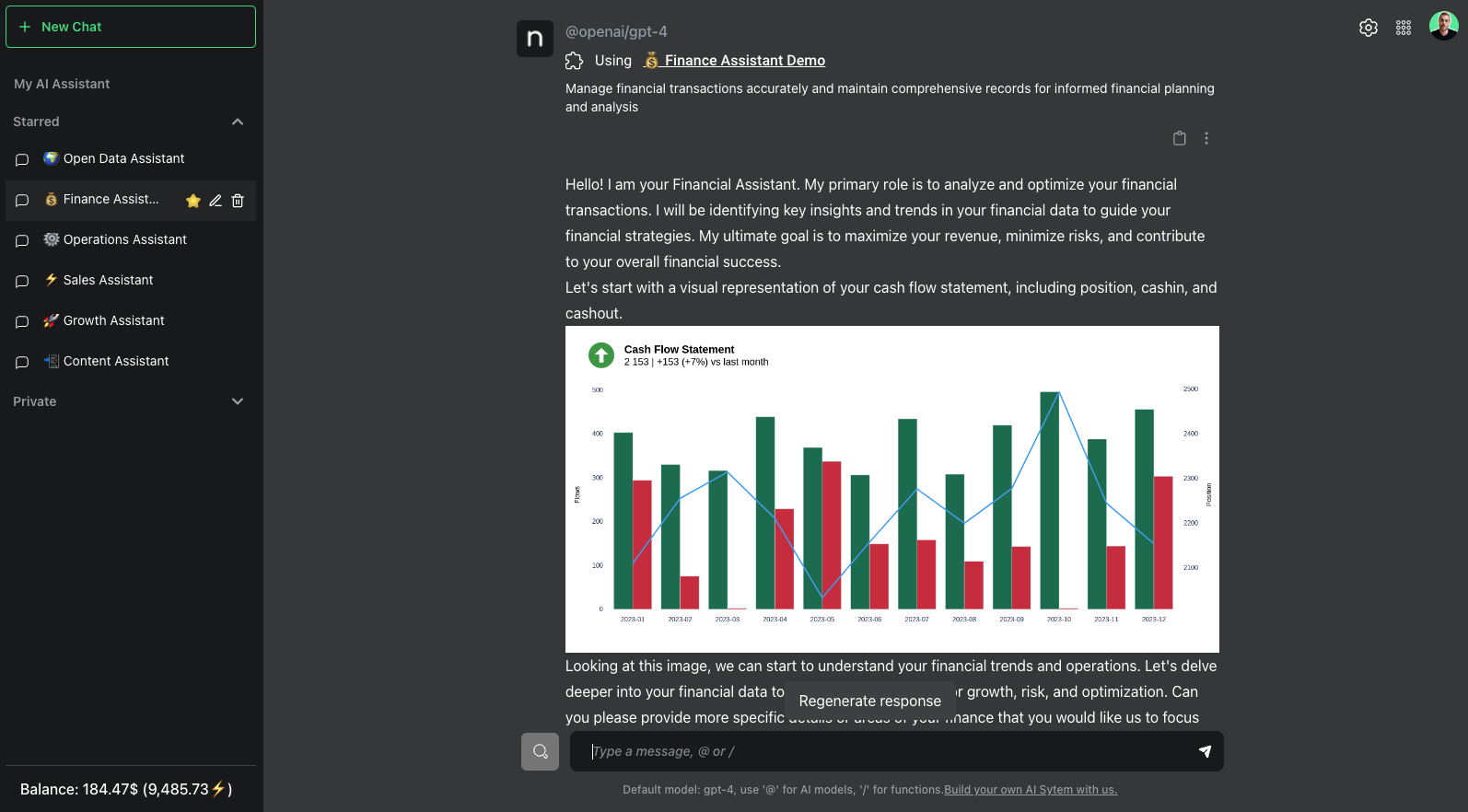

- Cash flow

- Budget variance

- Financial accuracy

- Compliance rates

Inputs

- SignNow or DocuSign for digital signatures

- Stripe for processing payments

- QuickBooks for accounting

Outputs

- CONTRACTS: All the contracts or agreements with suppliers or clients.

- TRANSACTIONS: Documents each financial transaction.

- LEDGER: Provides a comprehensive financial record.

Workflows

Contracts Validation

- Digital Signing: Utilize platforms like SignNow or DocuSign to obtain and verify digital signatures on contracts and agreements.

- Contract Management: Store and manage all signed contracts within a designated CONTRACTS table or database. Ensure easy access and retrieval for review and compliance.

Transaction Recording

- Data Entry: Document each financial transaction in the TRANSACTIONS table, including details like amount, date, category, and payment method (e.g., Stripe).

- Verification: Cross-verify transactions for accuracy and proper categorization against receipts, invoices, and contracts. This step ensures financial accuracy and compliance.

- Approval Process: Implement an approval process for large transactions to ensure they are reviewed by a financial manager before being finalized.

Ledger Maintenance

- Ledger Updating: Update the LEDGER table regularly to reflect all financial activities, ensuring a current view of the financial status.

- Reconciliation: Perform monthly reconciliations to ensure the ledger matches bank statements, Stripe accounts, and other financial records. Address any discrepancies immediately.

- Financial Reporting: Generate regular financial reports from the ledger, including cash flow statements, balance sheets, and income statements, for review by financial managers and stakeholders.

Financial Analysis and Planning

- Trend Analysis: Use financial data to identify trends over time, helping to forecast future financial performance.

- Budget Variance Analysis: Compare actual financial performance against budgets to identify variances, understand causes, and adjust plans as necessary.

- Strategic Decision Support: Provide financial insights and analyses to support strategic decision-making by financial managers and executives.

Customization

- Connect to GitHub for version control of financial documents and reports.

- Connect to Notion for collaborative financial planning and documentation.

Roadmap

- (Details on future plans for enhancing financial management processes, integration with new technologies, and compliance updates.)